The Best Strategy To Use For Clark Wealth Partners

Table of ContentsAn Unbiased View of Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutNot known Details About Clark Wealth Partners Some Ideas on Clark Wealth Partners You Need To KnowAn Unbiased View of Clark Wealth PartnersNot known Details About Clark Wealth Partners Top Guidelines Of Clark Wealth Partners

The world of money is a challenging one. The FINRA Structure's National Capacity Research Study, for example, just recently located that nearly two-thirds of Americans were not able to pass a fundamental, five-question monetary proficiency test that quizzed participants on subjects such as passion, financial debt, and various other reasonably fundamental ideas. It's little marvel, then, that we usually see headlines lamenting the bad state of most Americans' funds (Tax planning in ofallon il).In enhancement to handling their existing clients, monetary consultants will often spend a reasonable quantity of time weekly conference with prospective customers and marketing their solutions to preserve and grow their service. For those thinking about becoming an economic advisor, it is very important to think about the typical salary and task security for those working in the area.

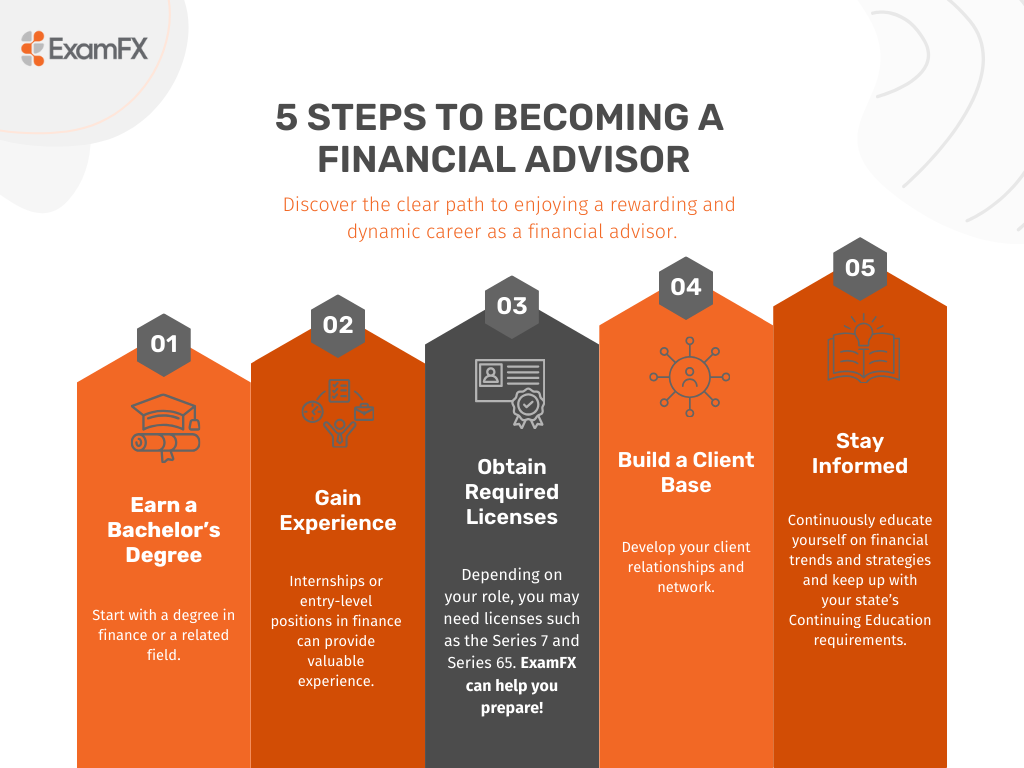

Programs in taxes, estate planning, investments, and danger monitoring can be helpful for trainees on this path as well. Relying on your special profession objectives, you might also need to make details licenses to satisfy particular customers' demands, such as buying and offering stocks, bonds, and insurance plan. It can also be practical to gain an accreditation such as a Licensed Financial Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

The Only Guide to Clark Wealth Partners

Numerous individuals choose to obtain help by using the solutions of a financial specialist. What that looks like can be a variety of things, and can differ depending upon your age and stage of life. Prior to you do anything, study is key. Some individuals worry that they need a particular amount of cash to invest before they can get help from a specialist.

An Unbiased View of Clark Wealth Partners

If you haven't had any kind of experience with a financial expert, here's what to anticipate: They'll start by supplying a detailed evaluation of where you stand with your possessions, liabilities and whether you're fulfilling benchmarks compared to your peers for savings and retirement. They'll evaluate short- and lasting goals. What's handy regarding this step is that it is individualized for you.

You're young and functioning full time, have a vehicle or 2 and there are student loans to pay off.

Clark Wealth Partners Can Be Fun For Anyone

You can talk about the following finest time for follow-up. Financial advisors generally have various rates of rates.

You're looking in advance to your retired life and helping your kids with higher education prices. An economic advisor can supply guidance for those circumstances and more.

The Best Strategy To Use For Clark Wealth Partners

Schedule regular check-ins with your planner to modify your strategy as needed. Stabilizing savings for retirement and college costs for your children can be difficult.

Thinking of when you can retire and what post-retirement years might look like can generate issues about whether your retirement savings remain in line with your post-work strategies, or if you have actually saved sufficient to leave a tradition. Assist your economic specialist recognize your method to cash. If you are a lot more conservative with conserving (and possible loss), their recommendations need to reply to your fears and worries.

Our Clark Wealth Partners Ideas

Intending for health and wellness treatment is one of the big unknowns in retirement, and a monetary professional can describe choices and suggest whether extra insurance coverage as defense might be useful. Before you start, attempt to obtain comfy with the idea of sharing your whole monetary picture with a professional.

Offering your professional a complete photo can assist them create a strategy that's focused on to all components of your economic condition, specifically as you're fast approaching your post-work years. If your funds are basic and you use this link have a love for doing it yourself, you might be great by yourself.

An economic expert is not just for the super-rich; any individual facing significant life shifts, nearing retirement, or sensation bewildered by financial decisions could take advantage of professional advice. This short article discovers the duty of monetary advisors, when you may require to consult one, and essential factors to consider for picking - https://experiment.com/users/clrkwlthprtnr. A financial consultant is a skilled specialist who assists customers manage their finances and make informed decisions that line up with their life goals

The smart Trick of Clark Wealth Partners That Nobody is Discussing

In comparison, commission-based consultants earn income with the monetary items they market, which may influence their referrals. Whether it is marital relationship, divorce, the birth of a kid, occupation modifications, or the loss of an enjoyed one, these occasions have one-of-a-kind financial implications, commonly calling for timely decisions that can have enduring results.